Is Danforth Insurance licensed to provide travel insurance coverage for visitors to Canada?

Yes, we are a licensed Canadian travel agency who is authorized to sell medical insurance for super visa, visitors to Canada, international students, work visa and travel insurance for Canadians travelling out of province or abroad.

Can I purchase travel insurance online on your website?

Yes, you can certainly purchase travel insurance online on our website in the following few steps. After completing purchase policy document will be emailed to you instantly.

Do I need medical insurance to visit Canada?

Super visa – It is mandatory to obtain a medical insurance of at least $100,000 for one year (365 days) if you are planning to visit Canada on super visa.

Visitors to Canada – It is highly recommended for visitors to Canada to obtain medical insurance when planning a trip to Canada on a temporary visa, student visa or work visa, etc. A single overnight stay in a hospital can cost more than $5000 therefore it is better to protect yourself from unforseen expenses in case of emergency medical situations.

New Immigrants/ Returning Canadians – It is highly recommended to obtain medical insurance until they get coverage under Government Healthcare such as OHIP.

Can I get refund if my super visa application is denied?

We provide 100% refund if super visa application is denied. We will need visa refusal letter as a proof to proceed to provide full refund.

Can I pay in monthly installments?

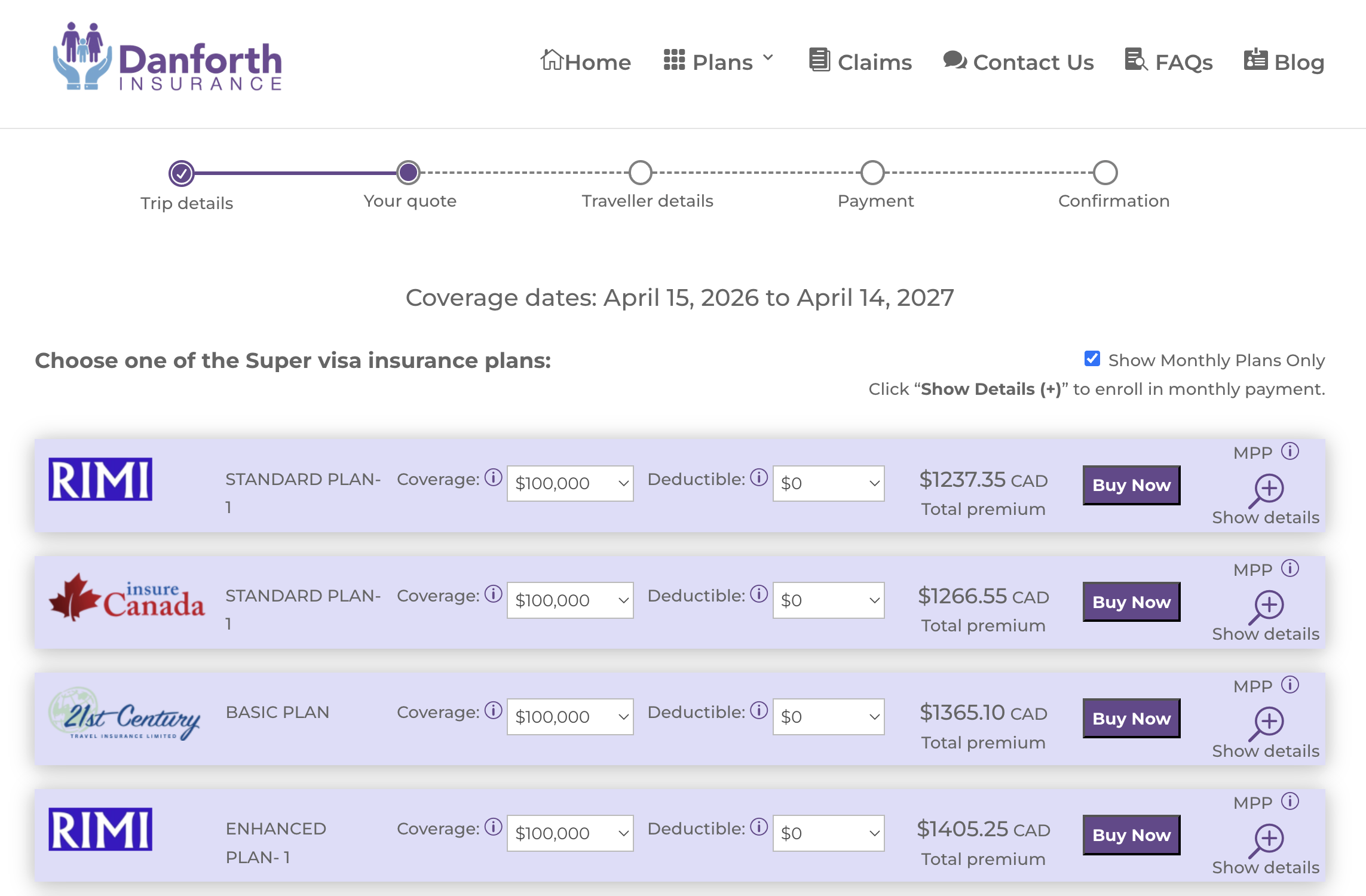

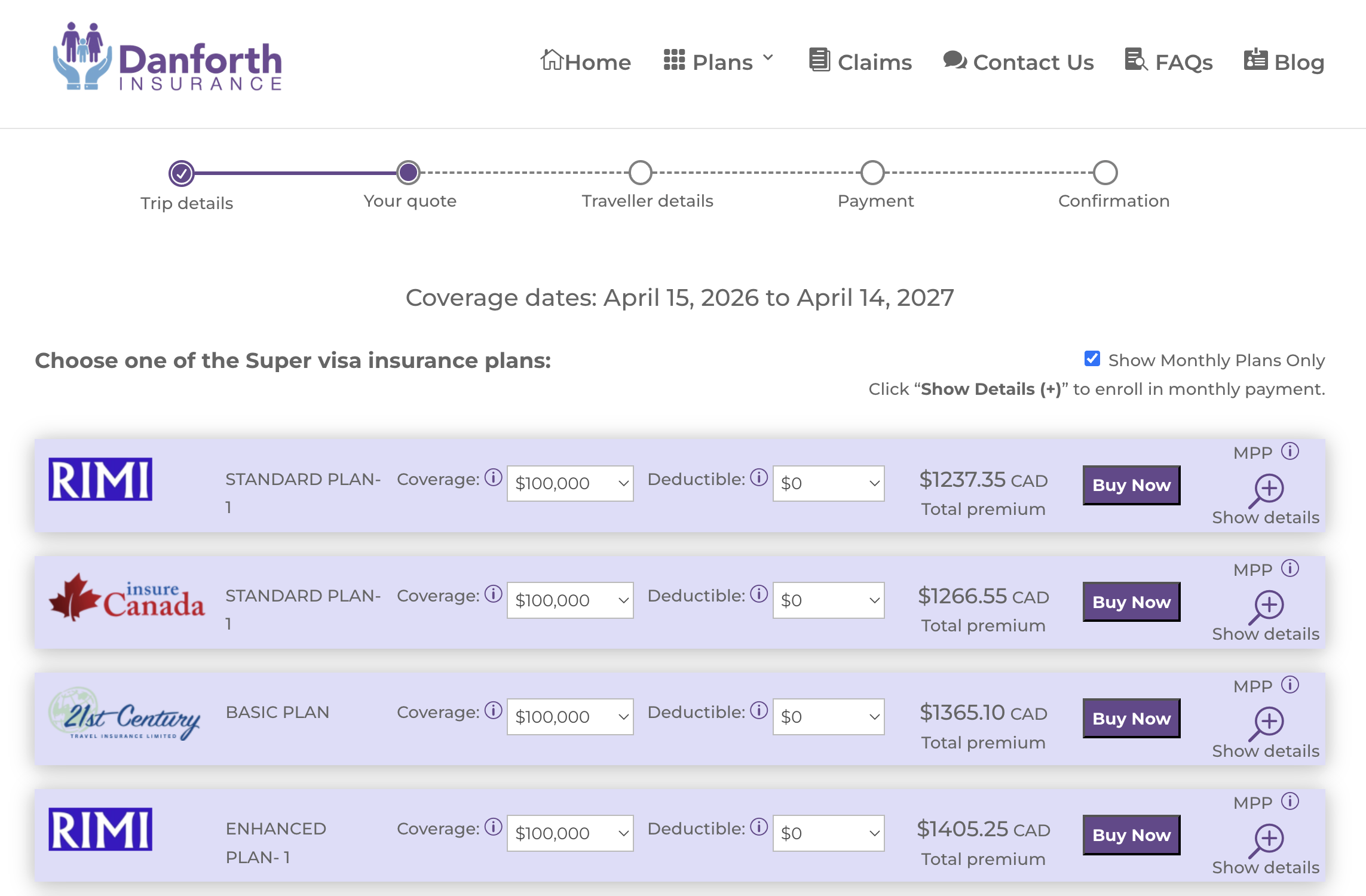

We understand that the cost of medical insurance can be significant. Our website offers a variety of Visitor to Canada insurance plans with options available for monthly payments. Monthly payment option is offered for coverage of $50,000 or more when purchased for a minimum period of three months. When you take quote on our website you will be presented with several plans. On the top right corner you can click on “Show Monthly Plans Only” to display plans that have monthly payment options available for you.

How do I buy super visa insurance or visitor to Canada insurance on monthly payment plan?

1. When take quote for visitor to Canada/Super visa insurance please click on “Show Monthly Plans Only” on top right corner as shown in the screenshot below.

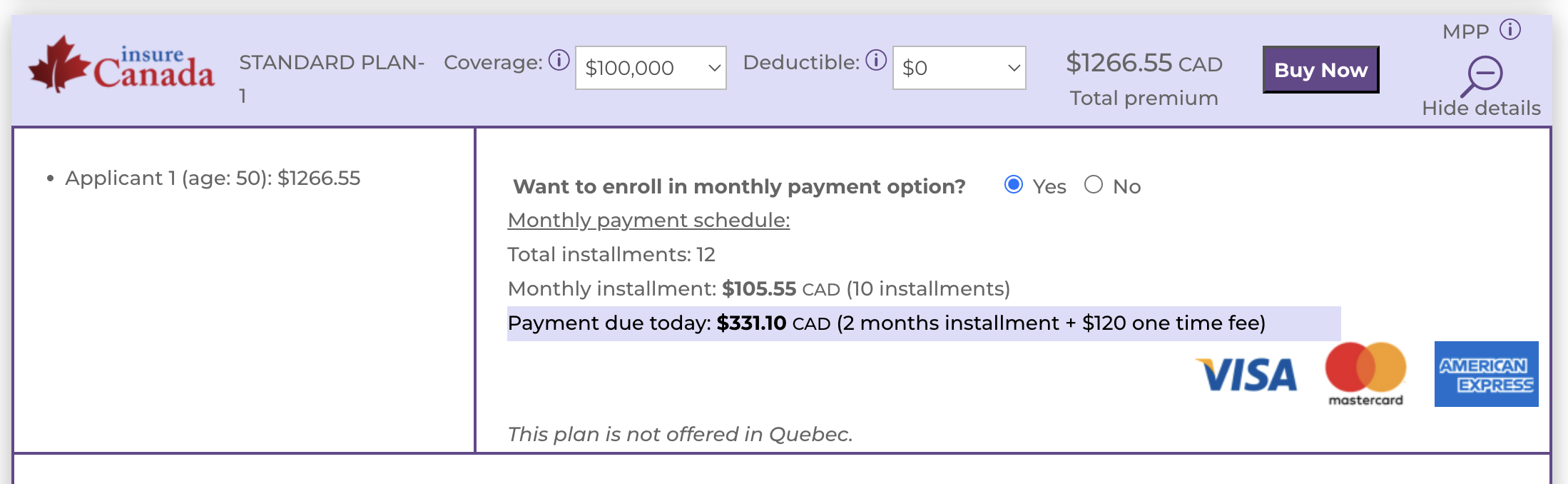

2. Click on “Show details” button on the plan you want to buy and choose “yes” for question “Want to enroll in monthly payment option?” as shown below.

3. After this click on “Buy Now” button to purchase insurance with monthly payment option.

Can I change policy start date after buying insurance?

Yes, we can change insurance start date on your request. This change is free of cost and insurance start date can be changed up to two years ahead of original insurance start date. You need to contact us at 647-350-0332 or email at info@danforthinsurance.com to make the changes to insurance start date.

Do you provide partial refund on visitor to Canada or super visa insurance in case of early return from Canada?

We do provide partial refund in case of early return from Canada minus administrative fee provided there is no claim on the insurance. We also have some insurance plans available that allow refund on early return even with the claims. Call us at 647-350-0332 to discuss partial refund options.

How many coverage options you provide for visitor to Canada Insurance?

We have several coverage options available ranging from $10,000 to $1 million. You can choose coverage options on your quote to get prices for each coverage.

What is deductible?

Deductible is the amount you must pay out-of-your pocket before your insurance covers medical expenses in the event of an emergency. On your quote display you can choose various deductibles to reduce insurance premium.

Do you have insurance plans available for all ages?

We have visitor to Canada insurance plans available for all ages with or with pre-existing medical conditions.